If you have any questions or would like to get in touch, submit a call back request and our team will contact you as soon as possible or call us on 020 7499 6424 or email us at [email protected]

The importance of remaining invested

Navigating the ups and downs of financial markets can be daunting. Remaining invested when markets fall may seem counter intuitive, but it can be the best way to not crystalise losses and avoid your portfolio underperforming over the longer term.

Trying to time the market can seriously damage your investment returns

Amidst heightened volatility, it is understandable that you may be concerned about the impact on the value of your investments. But, while sharp declines in markets can naturally be disconcerting, if you want to give your investments the best chance of earning a long-term return, then it’s a good idea to practice the art of patience.

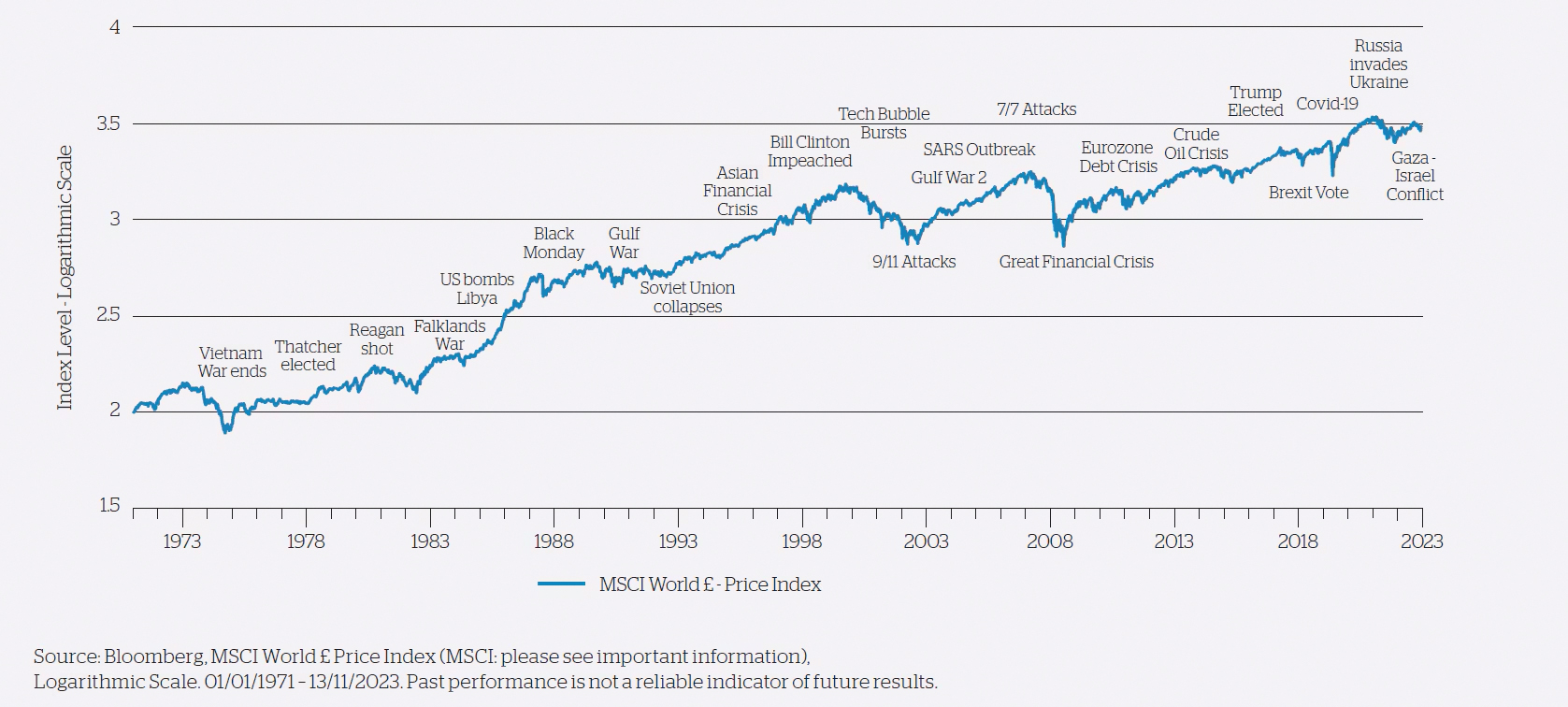

Events through time

When markets fall and fear dominates, it can be difficult to resist the temptation to sell out of the financial markets and switch to cash, with the idea of reinvesting in the future when feeling more positive about market prospects – trying to ‘time the market’. But this is a strategy that carries with it the risk of missing out on some of the best days of market performance. And this could have a devastating impact on long-term returns.

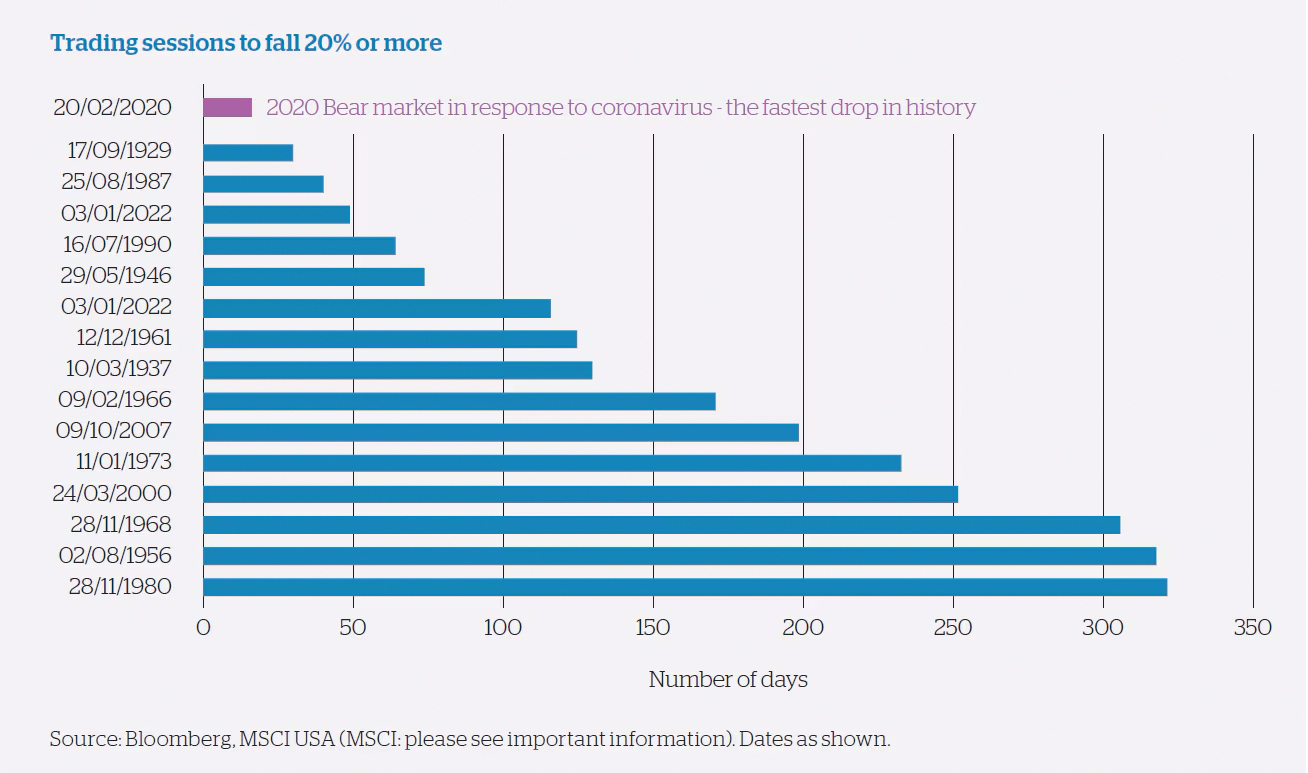

Remaining invested may be an emotional rollercoaster during times of market stress, but research shows time and again that this is the best investment approach over the long term. For example, one study of US equity mutual fund investors showed that their tendency to try and time the market was a key driver of their underperformance (Dalbar, 2019)(1). In the current environment, it is understandable that many people are concerned about geopolitical risks, and how this is being reflected in the value of their investments. To give some context, the speed at which the market entered into bear territory (typically a 20% decline) in response to the coronavirus pandemic was the fastest in history, as show in the chart below.

Trading sessions to fall by 20% or more

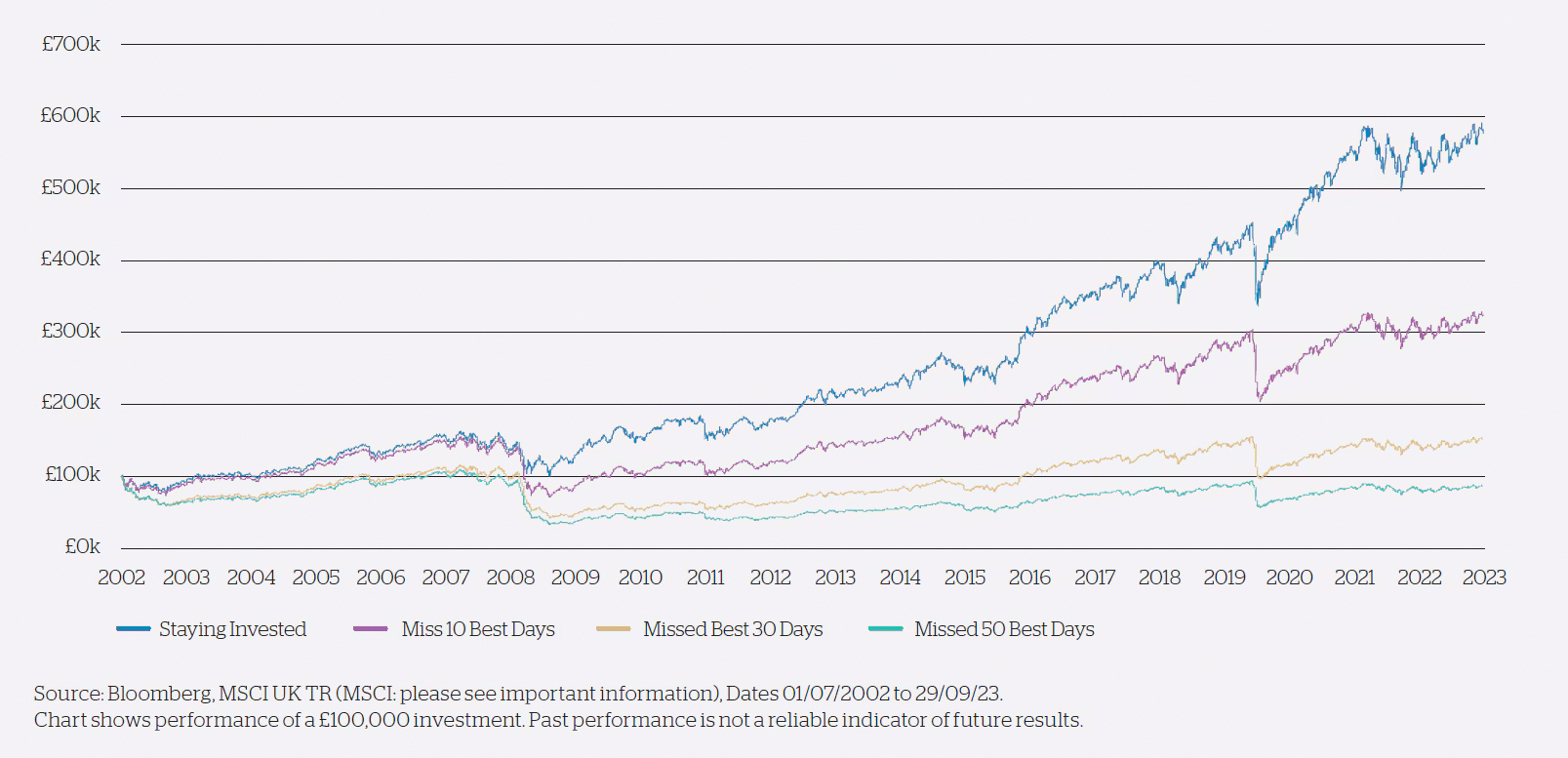

Despite temptations to switch into cash, data shows that missing out on just the 10 best market performing days can have a big impact on long-term returns.

Staying ‘fully invested’ during the ups and downs has resulted in an initial £100,000 portfolio, for example, having an ending value of £578,000, compared to £321,000 for those that missed the 10 best days in previous 20 years. This effect also highlights the powerful effect of ‘compounding returns’ over time. If, for example, the 50 best days are missed, the long-term returns are indeed negative.

Timing the market

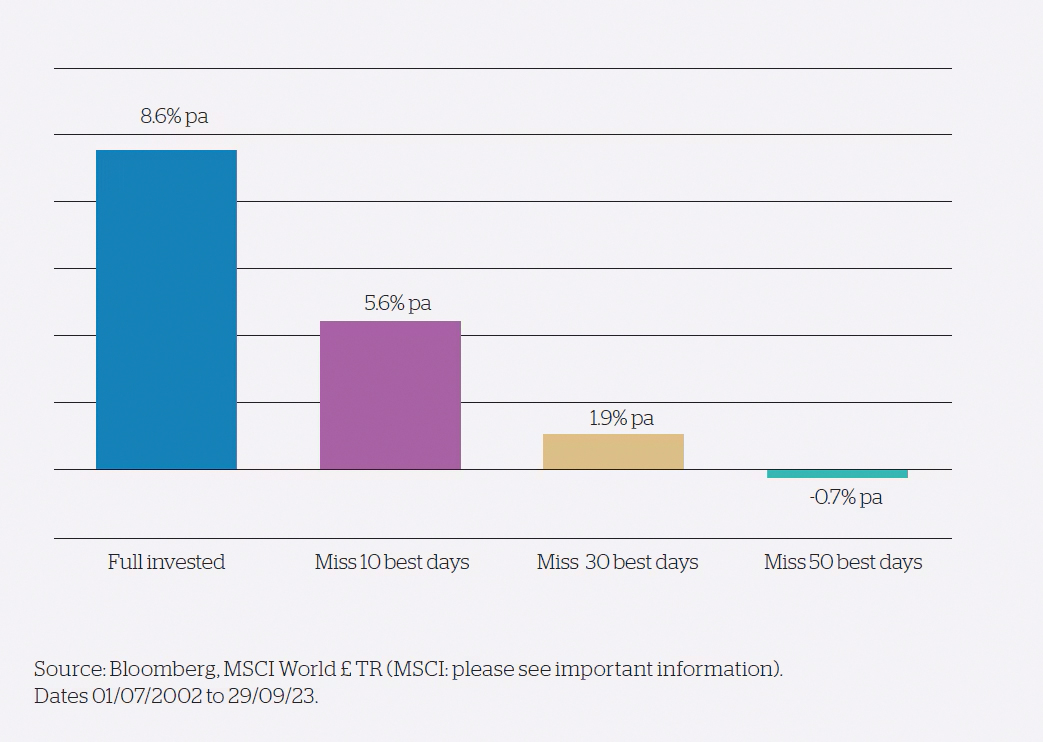

A different way of delivering the same message, where staying invested over the 20-year period generates annualised returns of 8.6%, compared to 1.9% annualised returns if one misses the 30 best days:

Staying invested

One of the most common reasons investors lose money is when they try to time the market,trying to avoid the worst days of the stock market by cashing out and then re-investing when they think the market is going to pick up. However, as the chart below shows, the best and worst days of the stock market cluster. Try to miss the lows and you’ll probably miss the highs too.

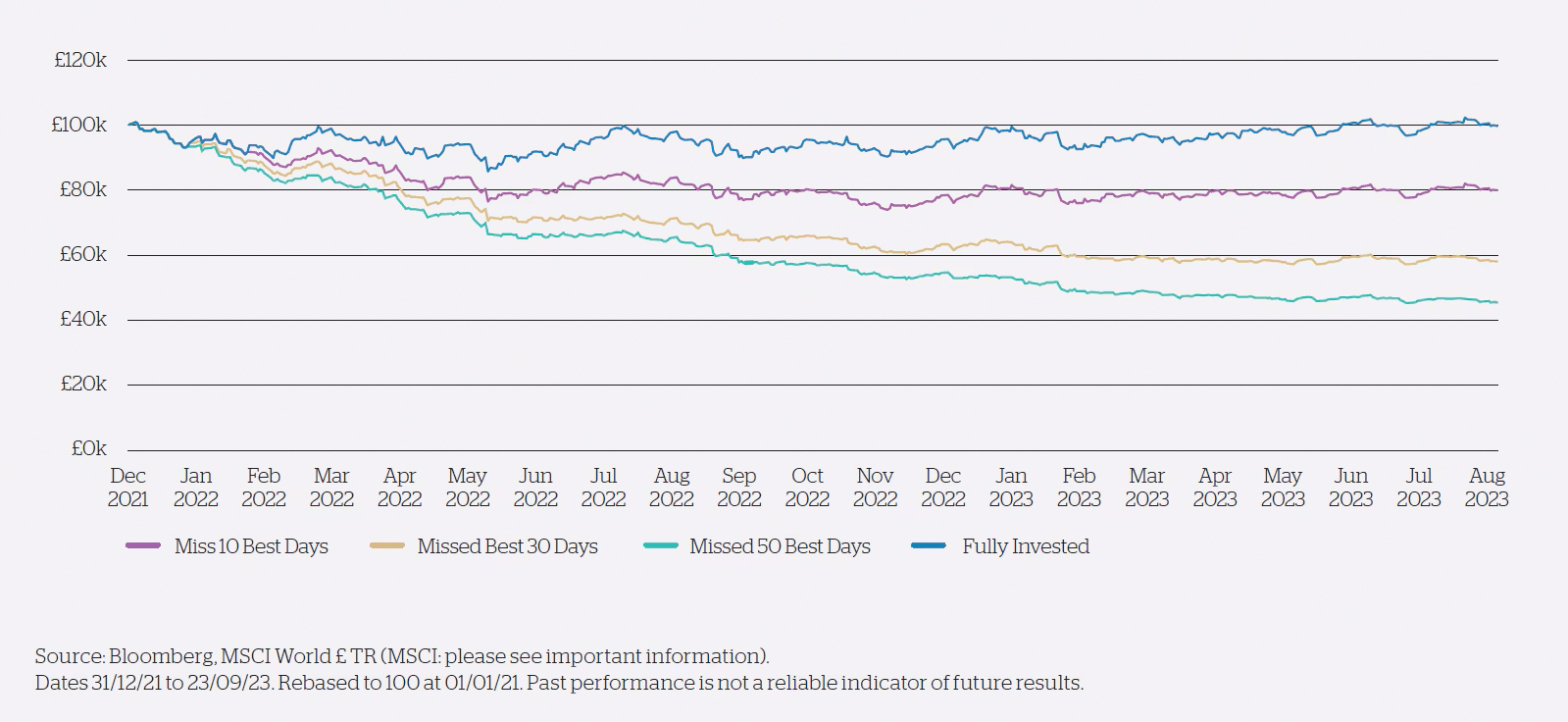

Missing the best days during the downturn and subsequent upturn can again have a large impact on the returns generated over the subsequent period.

Missing the best days during COVID-19 recovery

With the benefit of hindsight, we are now fully aware of the global impact of COVID-19, and the rapidity in which it has hit equity markets. While markets rivalled the speed of the virus in trying to price-in the near-term damage, we expected they could also be swift to act when a tipping-point was seen to be close- at-hand. World equity markets returned to highs around 120 days following 2020 lows.

By keeping to an established and proven investment framework, we can look to take advantage of short-term volatility as we continue to seek out longer-term investment opportunities. We look to avoid behavioural biases that may result in decisions that negatively impact long-term return potential. Yes, the journey may not be smooth, but generally it is important to look through the noise, and remain invested during times of market stress.

Footnotes

(1) Dalbar (2019). ‘Quantitative Analysis of Investor Behaviour

Request an initial consultation

Request an initial consultation

If you have any questions or would like to get in touch, submit a call back request and our team will reach out.

Get in touch

Get in touch

or call us on: 020 7499 6424

or email us at: [email protected]