If you have any questions or would like to get in touch, submit a call back request and our team will contact you as soon as possible or call us on 020 7499 6424 or email us at [email protected]

Is cash king again?

Cash savers are currently enjoying the highest returns in nearly two decades, with some popular savings accounts offering fixed-term deposit rates over 5% p.a. After a prolonged period of virtually zero return on cash, rates today are multiple times higher compared to previous years, and investors are naturally keen to put more into cash than they have done so previously. So, are investors right to prioritise cash? To answer this question, we examine the role of cash in the context of inflation, investment horizon and opportunity cost of reinvestment. Despite the current attractiveness of cash deposit rates, cash may not be the best place to be for long-term investors.

Cash is not inflation-proof

Cash offers certainty only in its nominal value but not its real value, which is measured by the resilience of its purchasing power over time. Inflation erodes the purchasing power of any asset. While cash may retain its real value to some extent during periods of low inflation, its purchasing power rapidly diminishes during times of high inflation. In fact, in the past two decades, there were only three isolated years where cash managed to outperform inflation and retain its purchasing power. Even during the era of subdued inflation that preceded the COVID pandemic, deposit rates languished at levels even lower. Despite the recent surge in cash rates, they still fall short of the prevailing higher inflation rates. Consequently, relying solely on cash rates often proves inadequate in terms of providing comprehensive real value protection.

A diversified portfolio could be a better option for long-term investors

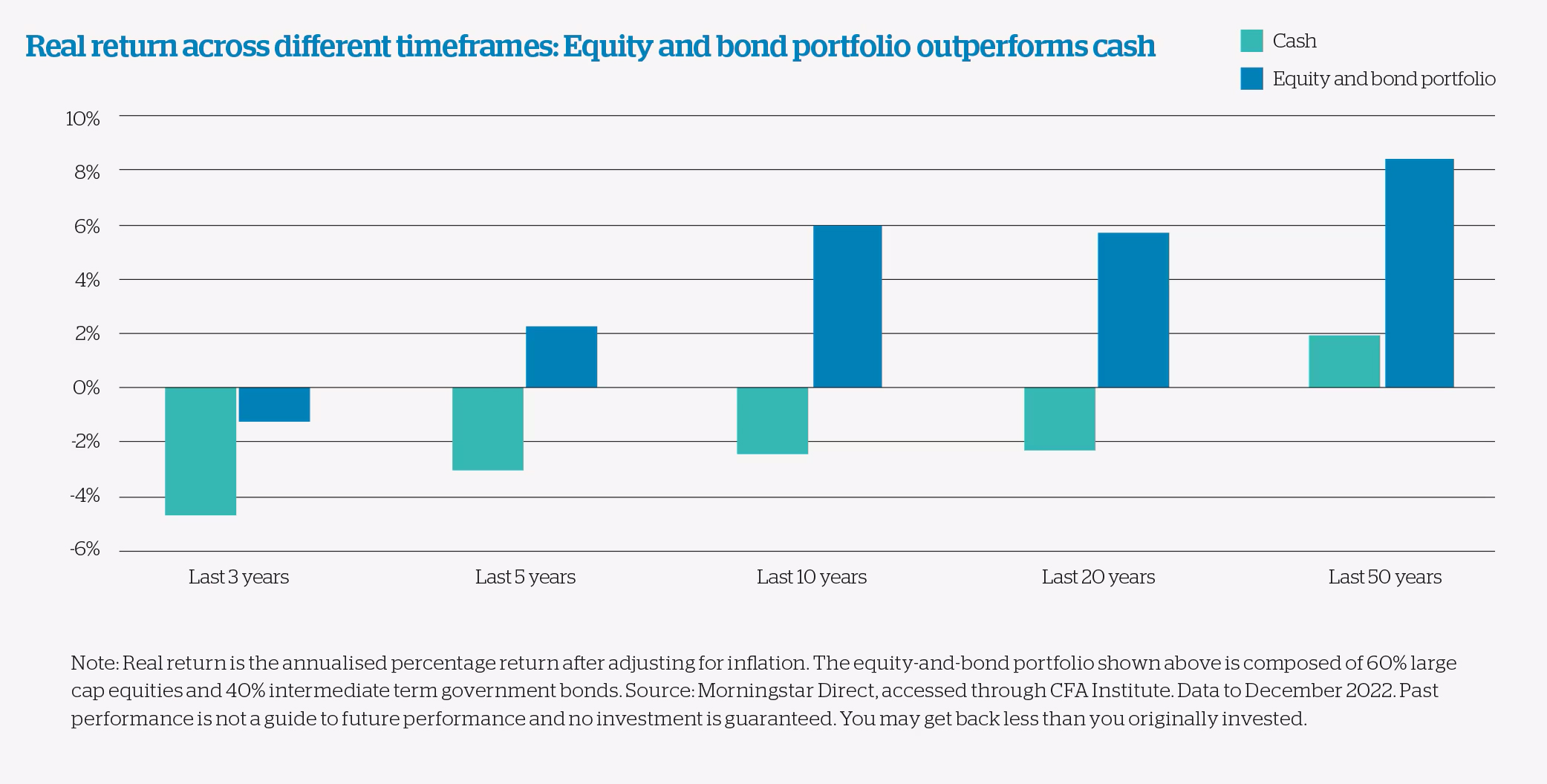

It is important to examine the case for cash in comparison to other investment instruments such as equities and bonds. For investors with long-term goals, a diversified 60% equities and 40% bonds portfolio can hold greater potential for generating real returns. If we examine the excess returns of cash vs. an equities and bonds portfolio across varying time horizons, we see that over the past 3, 5, 10 and 20 years, cash savings have delivered negative real returns, thereby diminishing the purchasing power of depositors. While cash managed to retain a level of real value over a 50-year period which will incorporate many different economic cycles, it is still lower than the returns generated by the equities and bonds portfolio. By contrast, the equities and bonds portfolio has consistently delivered returns that outpaced inflation across timeframes of 5 to 50 years, regardless of the prevailing macroeconomic conditions.

Past performance is not a guide to future performance and no investment is guaranteed. You may get back less than you originally invested.

Hidden costs of fixed-term deposits

Investors attracted by the higher rates offered by fixed-term deposits are often locked in for a period of time. One key consideration for depositors in these situations is reinvestment risk, which is the risk of earning lower returns when choosing a new investment after their original fixed-term investment has expired. Once the fixed rate reaches its end, they must either renew at potentially lower rates or explore alternative investment options. However, the financial landscape at that time could differ significantly, and the investor could have missed attractive entry points in equity and bond markets. Historical analysis also reveals that high deposit rates rarely persist over an extended period. Looking at past patterns, in the five previous hiking cycles, the Bank of England typically maintained peak interest rates for an average of 9 months between its last hike and its first rate cut. It is unlikely for higher rates to endure, and investors risk sacrificing long-term opportunities for the allure of short-term ‘guaranteed’ gains.

What does it mean for investors?

While current cash deposit rates may be attractive, investors should carefully evaluate the role of cash in light of inflation, investment horizon, and reinvestment risks. So, whilst holding cash can be a useful tool for investors with a very short investment horizon, a diversified investment portfolio could provide better returns for investors seeking to preserve and grow their wealth over the long term.

Important information

Investors should be aware that the price of investments and the income from them can go down as well as up and that neither is guaranteed. Past performance is not a reliable indicator of future results. Investors may not get back the amount invested. Changes in rates of exchange may have an adverse effect on the value, price or income of an investment. Investors should be aware of the additional risks associated with investing in smaller companies, emerging or developing markets. The value of your investment may be impacted if the issuers of underlying fixed income holdings default, or market perceptions of their credit risk change.

The information in this document does not constitute advice or a recommendation and you should not make any investment decisions on the basis of it. This document is for the information of the recipient only and should not be reproduced, copied or made available to others.

Brooks Macdonald is a trading name of Brooks Macdonald Group plc used by various companies in the Brooks Macdonald group of companies. Brooks Macdonald Group plc is registered in England No: 04402058. Registered office: 21 Lombard Street, London, EC3V 9AH.

Brooks Macdonald International is a trading name of Brooks Macdonald Asset Management (International) Limited. Brooks Macdonald Asset Management (International) Limited is licensed and regulated by the Jersey Financial Services Commission. Its Guernsey branch is licensed and regulated by the Guernsey Financial Services Commission and its Isle of Man branch is licensed and regulated by the Isle of Man Financial Services Authority. In respect of services provided in the Republic of South Africa, Brooks Macdonald Asset Management (International) Limited is an authorised Financial Services Provider regulated by the South African Financial Sector Conduct Authority. Registered in Jersey No: 143275. Registered office: 5 Anley Street, St Helier, Jersey, JE2 3QE.

Request an initial consultation

Request an initial consultation

If you have any questions or would like to get in touch, submit a call back request and our team will reach out.

Get in touch

Get in touch

or call us on: 020 7499 6424

or email us at: [email protected]