If you have any questions or would like to get in touch, submit a call back request and our team will contact you as soon as possible or call us on 020 7499 6424 or email us at [email protected]

Do annuities have a place in my portfolio?

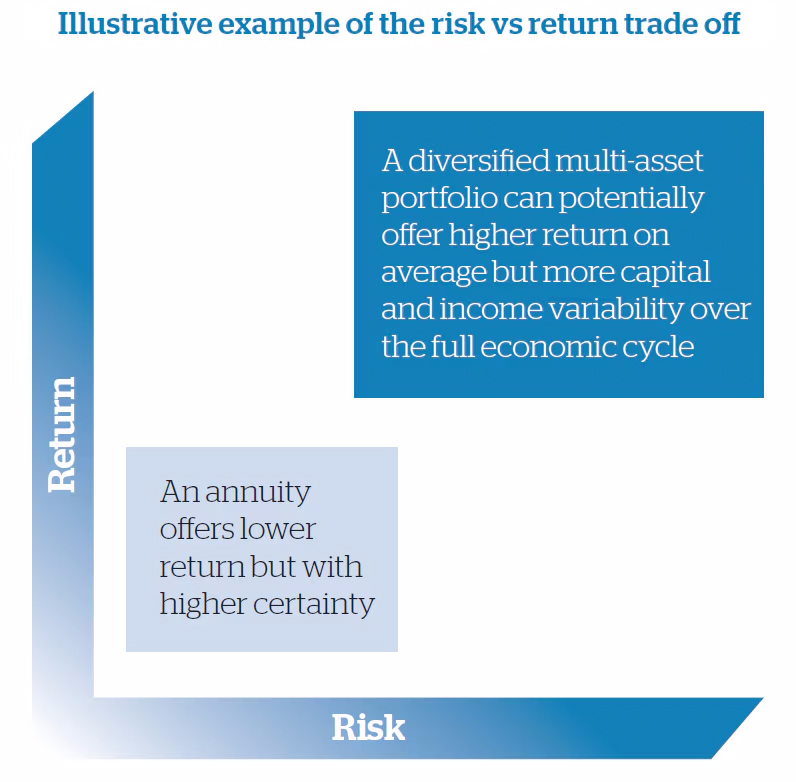

When planning for retirement, clients often grapple with the decision of whether to invest in a multi-asset portfolio or opt for the relative simplicity of purchasing an annuity. Both options have their merits and drawbacks, and the choice ultimately depends on your financial objectives, risk tolerance, and personal circumstances.

What is an annuity?

An investor buys an annuity by paying an insurer a lump sum upfront amount, and in return, the insurer guarantees a regular income which can either last for life or a predetermined period. Annuities provide a reliable income stream, offering a sense of financial security during retirement.

Prior to 2022, the ultra-low interest rate environment impacted annuity rates and many investors were discouraged from considering them as the rates paid were relatively low. However, with the recent increase in interest rates, annuities have become more appealing. For instance, a retiree with £100,000 could expect to receive approximately £5,000 annually just a couple of years ago, but the same sum could yield nearly £7,000 in a fixed annuity scheme. This can make annuities an attractive proposition, particularly if you have a low appetite for risk and are seeking guaranteed, life-long income.

What are the trade-offs over the long term?

Clients can be drawn to the relative security of an annuity income, at a time when investments in stocks and bonds have experienced significant volatility due to concerns about higher inflation and the uncertain economic outlook.

Annuities provide downside protection as your invested amount is not impacted by short-term market volatility and income is agreed and fixed at purchase. However, investors do forego the opportunity to grow their investment or participate in the upside potential when markets rally.

This is in comparison to multi-asset portfolios, which combine a variety of different asset classes, that offer upside gains when markets go up but can be impacted by market volatility and the value of your investments can go down. It's important to understand that annuity rates are not isolated from broader market dynamics. If long-term yields are rising, long-run return expectations on risk assets, such as equities, may also increase over time. This would mean, over a full economic cycle – the fluctuations of the economy between periods of expansion (growth) and contraction (recession), the average return on risk assets could outperform annuity rates.

Another consideration is that annuities mean surrendering control of the invested funds. The lack of liquidity and flexibility makes it challenging to access a lump sum if needed. In contrast, having control over your investments and the flexibility to respond to unforeseen financial challenges or investment opportunities can be a significant advantage of a multi-asset portfolio.

Building a dual-purpose portfolio that stands the test of time

The choice between a multi-asset portfolio and an annuity doesn't have to be a binary decision. Annuities have a unique value proposition when it comes to income security. However, in a rational market, taking on a measured amount of market risk could lead to incremental gains that compound over the long term, potentially resulting in substantial excess returns. Hence, a combination of a multi-asset portfolio and annuities can potentially be a powerful solution.

Annuities can secure a minimum level of income, providing peace of mind, while the multi-asset portfolio allows you to take more calculated risks with the remainder of your retirement funds. During challenging times, the annuity portion guarantees a steady stream of cashflow, acting as a financial safety net. During market rallies, you can still benefit from the potential upside of your investments. By diversifying your investment approach and maintaining a long-term perspective, you can navigate the complexities of retirement planning, retain a greater degree of control, and potentially achieve your financial goals more effectively. This balanced strategy aligns with the evolving needs of today's retirees, offering a path that combines a level of income security and growth potential.

Request an initial consultation

Request an initial consultation

If you have any questions or would like to get in touch, submit a call back request and our team will reach out.

Get in touch

Get in touch

or call us on: 020 7499 6424

or email us at: [email protected]