If you have any questions or would like to get in touch, submit a call back request and our team will contact you as soon as possible or call us on 020 7499 6424 or email us at [email protected]

The US election rematch: only short-lived volatility predicted

Market Commentary

In summary

Preparing for a Joe Biden vs Donald Trump rematch: Matthew Cady, Investment Strategist, explains the likely impact of this year’s US presidential election on markets.

The United States is gearing up for another presidential election on Tuesday, 5 November. With the political stage set, we have a rematch between two people who have been president once before: current president Joe Biden (Democrat) and former president Donald Trump (Republican).

The latest polls are churning out mixed signals, leaving the outcome shrouded in uncertainty. The campaign engines are running at full throttle, and news outlets are abuzz with election talk. Amid these noises, it is easy to get sidetracked when making sound investment decisions. However, drawing from history we can distil two important lessons from past elections that can guide our investment thinking and provide a sense of reassurance.

Lesson 1: Markets often rally once political uncertainty goes away

Investment markets are no stranger to volatility, and election years are no exception. As the countdown to the polls begin, markets often exhibit heightened sensitivity, particularly when the race is neck and neck. This uncertainty can increase market fluctuations, prompting some investors to scale back their risk exposure. However, these same investors typically re-enter the market once the election outcome is clear.

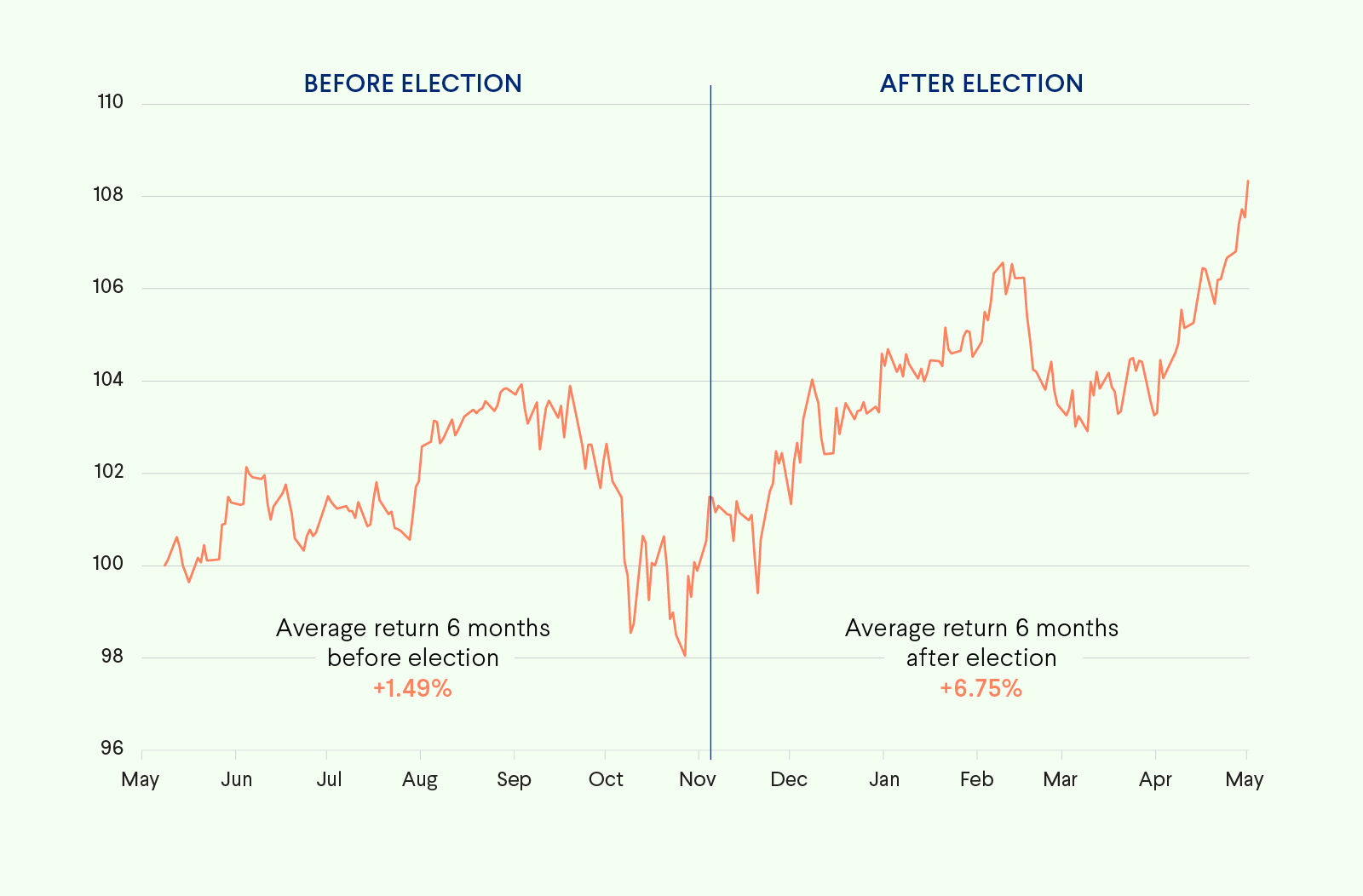

In the past, the resolution of electoral uncertainty has frequently been followed by a market rally. The chart below shows that the average US equity market return six months before an election was +1.49%, whereas the average return six months after the election was +6.75%. This pattern underscores the market's preference for stability and predictability over the unknown. It is also an important reminder that a key determinant of longer-term investment returns is staying invested during periods of market volatility. At the end of the day, it is ‘time in the market’, not ‘timing the market’ that counts more.

Chart: Average US equity market performance across the last eight US presidential elections.

Source: Bloomberg, MSCI, MSCI USA (Price return USD dollars) is used as a proxy for equity return. Past performance is not an indicator of future returns.

Lesson 2: Markets care more about the economy and less about politics

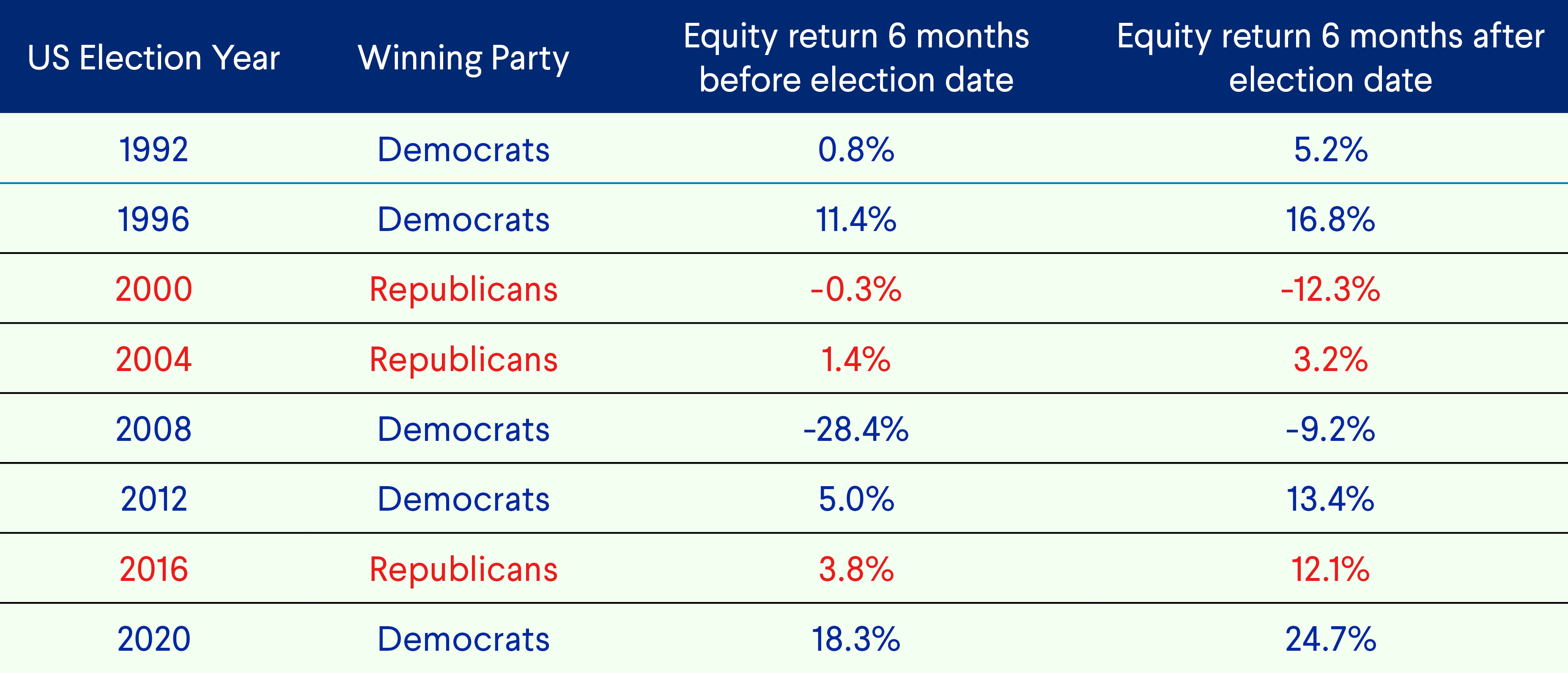

Contrary to popular belief, markets are often indifferent to which political candidate emerges victorious in an election. As shown in the table below, equity market returns were largely independent of the political outcome over the past eight US elections. While some fear that markets might take a hit if a certain candidate or party wins, the prevailing economic conditions typically have a more substantial impact on market performance.

For instance, in 2020, the market was more heavily influenced by the pandemic lockdowns and the subsequent economic reopening than by the political ideologies of the candidates. Similarly, in 2008, the defining moment for the market was the global financial crisis, not the presidential candidates' positions on issues like the Iraq War or US healthcare reform.

Table: Historical election outcome and equity market return

Source: Bloomberg, MSCI, MSCI USA is used as a proxy for equity return. Past performance is not an indicator of future return.

Looking beyond the political horizon

Political events can undoubtedly evoke strong emotions, but it is vital to keep an eye on the long-term investment horizon. We believe that core economic fundamentals will continue to be the main driver of market trends. However, we are mindful that risks such as inflation and geopolitical tensions could pose challenges to the investment landscape. Despite the political uncertainty, the investment outlook is generally positive as we head into US elections later this year.

On balance, we see steady economic growth, supportive fiscal policy and easing inflationary pressures allowing central banks to lower interest rates. Collectively, this should all continue to sustain corporate and consumer outlooks. As such, we believe there are plentiful opportunities for multi-asset investors, and crucially, this holds true regardless of who sits in the Oval Office.

While the presidential election is a significant political event, investors should arguably focus more on the broader economic landscape and maintain a long-term perspective. This approach can help to navigate the markets as effectively as possible, providing peace of mind by reducing worries about short-term market fluctuations.

Important information

The information in this document does not constitute advice or a recommendation and investment decisions should not be made on the basis of it. The price of investments and the income from them can go down as well as up and neither is guaranteed.

Brooks Macdonald is a trading name of Brooks Macdonald Group plc used by various companies in the Brooks Macdonald group of companies. Brooks Macdonald Group plc is registered in England No: 04402058. Registered office: 21 Lombard Street London EC3V 9AH. Brooks Macdonald Asset Management Limited is regulated by the Financial Conduct Authority. Registered in England No: 03417519. Registered office: 21 Lombard Street, London EC3V 9AH.

Brooks Macdonald International is a trading name of Brooks Macdonald Asset Management (International) Limited. Brooks Macdonald Asset Management (International) Limited is licensed and regulated by the Jersey Financial Services Commission. Its Guernsey branch is licensed and regulated by the Guernsey Financial Services Commission and its Isle of Man branch is licensed and regulated by the Isle of Man Financial Services Authority. In respect of services provided in the Republic of South Africa, Brooks Macdonald Asset Management (International) Limited is an authorised Financial Services Provider regulated by the South African Financial Sector Conduct Authority. Registered in Jersey No: 143275. Registered Office: Third Floor, No 1 Grenville Street, St. Helier, Jersey, JE2 4UF.

Request an initial consultation

Request an initial consultation

If you have any questions or would like to get in touch, submit a call back request and our team will reach out.

Get in touch

Get in touch

or call us on: 020 7499 6424

or email us at: [email protected]